Blog

2016 Federal Budget Update

On Tuesday, 3 May 2016, Scott Morrison, the Federal Treasurer, exposed his first Federal Budget. The Budget announcements embrace some major superannuation tax changes, and other measures which effect individual income tax, small businesses, and corporate taxation. Below is a summary of some of the key Federal Budget features in relation to tax and superannuation. […]

An Eye for Now, an Eye for the Future

Let Pre Year End Tax planning be more than just getting a bigger refund It’s the last quarter of the financial year. It’s the best time to review your profits, estimate your tax bill and determine what you can do to get your tax bill as low as possible (or your refund as high as […]

Success Accounting Group’s Super Stream Solution for Employers before 30 June 2016

As you are preparing for your BAS returns this quarter, now is a good time to also review if your business is Super stream compliant and aim to implement way before the deadline of 30 June 2016. Under SuperStream, you need to pay super contributions for your employees electronically (EFT or BPAY) and send the […]

FBT 2016: 5 Things Every Business Should Know

How do I Know if I need to pay FBT? What is exempt from FBT? And what to be aware of come 1 April 2016. Do you know that the FBT rate goes up from 47% to 49% from 1 April 2016? As an employer, we need to start reflecting this new rate in current […]

Which Business Structure is Right For You?

It is important to consider the advantages and disadvantages of the various business structures available and to choose the best structure to suit your circumstances. So what are your options? Sole Trader A sole trader is the simplest and cheapest business structure you can select from as it has few legal and tax regulations. As a […]

Small Business Restructure – Capital Gains Tax Roll-Over Relief

Sufficient asset protection, estate planning and tax planning all stems from having the correct business structure. Not only does your choice of business structure affect the safety of your personal assets and your tax position but it also impacts the continuity of the business upon change of ownership and what registration processes you will […]

SuperStream Deadline Approaching!

The new way of processing Superannuation Payments is almost here. Are you ready? In its bid to streamline the processing of transaction for superannuation funds, the ATO has introduced SuperStream. The main aim of SuperStream is to ensure employer superannuation contributions are paid in a consistent, timely and efficient manner. The key component of SuperStream […]

Umbrella of Services

At Success Accounting Group we are passionate about promoting growth in our clients and our services go far beyond completing your financial reports. If you are not looking for a typical accountant to simply do your tax nor are you looking for a product focused financial planner check out our services that we proudly offer! […]

Keep Your Family Wealth in Your Bloodline

Are you aware that if any of your children have a failed relationship, their share of your family wealth could end up going to another family? This is very serious. You work so hard to build up your family assets. But what if any of your children are in a relationship, inherited family wealth […]

6 Reasons Why Businesses Fail and How to Avoid Being Next

Entrepreneurs are exposed to many risks when starting a business; foreclosure is one of the inevitable ones. Today we will go over 6 common pitfalls as to why businesses fail and how you can protect your prized business from being the next one. 1. A staggering 61% is the inability to manage costs – cost […]

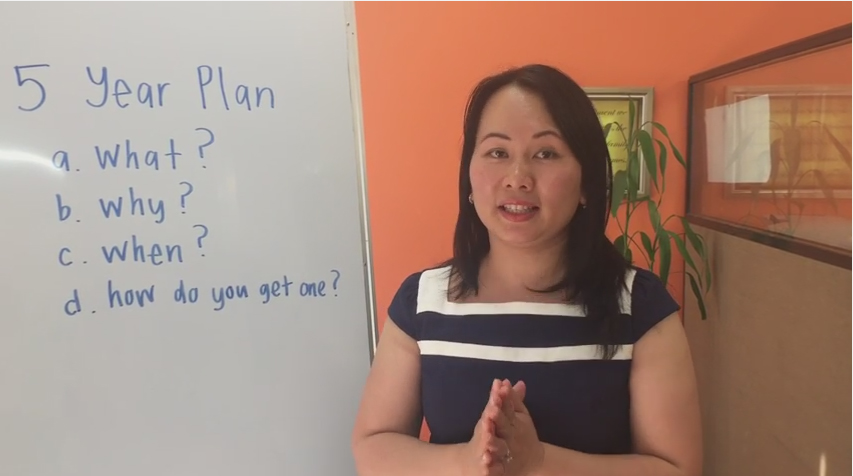

5 Year Plan

Having a plan for 2016 and beyond ensures that you arrive at your destination. Be sure to contact the team to develop or revise your 5 year plan by scheduling an appointment. Look forward to seeing all our friendly clients in the New Year. Register for the free webiner here!

Minimise FBT at your Year-End Party

Did you have a great time with family & friends over the holiday season? Don’t want frustrating form-filling for FBT to ruin the holiday? We all like to party, but none of us want to pay Fringe Benefits Tax (FBT) if we don’t have to. So if you, as an employer, had a Christmas party […]